While key consumer credit metrics continue to deteriorate, there are some encouraging signs

Listen to 702’s interview here: Consumer credit metrics continue to deteriorate with some encouraging signs

Challenging Q2 2023, but encouraging signs from the Western Cape

Eighty20 has released its 2023 Q2 Credit Stress Report in collaboration with Xpert Decision Systems (XDS). The Credit Stress Report probes consumer credit behaviour and cites key events from quarter two that had an impact on the current economic landscape.

It has been a long, cold winter in South Africa, with the gloomy climate reflected in our political and economic situation, culminating in what felt like one of our darkest days in May, when the US Ambassador accused South Africa of supplying arms to Russia, causing the rand to plummet. Against this background the quarter saw credit defaults continue to increase, especially with secured debt, and certain segments continuing to exit the credit market either through choice or default. On the positive side, the Western Cape is performing markedly better than other provinces, reflecting some positivity for the future.

Download the Credit Stress Report

A gloomy quarter two

Across most credit metrics, the situation worsened in Q2 with the number of defaults and overdue balances continuing to escalate. Eighty20’s research uses the Rate of New Default (RND) metric to measure credit stress. RND is the percentage of current loan balances that went into default this quarter. The change in RND (CRND) is the percentage change in the current quarter’s RND relative to the RND in same quarter a year ago. The CRND for all loans, currently up 29.2% is in its third consecutive quarter of double-digit increases. This significant increase shows an escalating trend with the CRND on all loans up 15.6% in Q4 2022 and 17.4% in Q1 2023.

Home loans in particular deteriorated with the CRND for home loans up 52%, with a 29% annual increase in average mortgage installments. Last quarter, the CRND for home loans was at 28% with a 2% annual increase in average mortgage installments “This situation is particularly prevalent for the top 5% of South Africans who have 75% of all home loans by value. Within the Eighty20 National Segmentation, the wealthier Heavy Hitters segment have a CRND for home loans at 61%, VAF at 25%, with Credit Card up to 23%,” says Andrew Fulton, Director at Eighty20.

|

Company financial results from Q2 have also painted a similar picture for the banking sector. Standard Bank’s Personal & Private Banking division reported a 26% increase in its impairment charge for the half year, while ABSA saw credit card impairments in its Everyday Banking division surge 70% and Nedbank’s rising to 57% for the first six months of 2023. African Bank fared much worse with impairment charges on loans and advances growing by 240%. Grocery retailers echoed the gloomy outlook, with both Pick ‘n Pay and Shoprite speaking to low consumer volume growth coupled with the impact of the hundreds of millions of rands spent on keeping generators running.

Western Cape fares better

Eighty20’s analysis highlighted a significant difference in the credit environment among the provinces. The latest StatsSA Labour Force Survey revealed the official unemployment rate in the Western Cape is 20.9%, significantly lower than Gauteng at 34.4%, and the country at 32.6%. Furthermore, job growth in the Western Cape has witnessed a YoY growth of 15.7%, versus 4.2% for Gauteng (5% for the country).

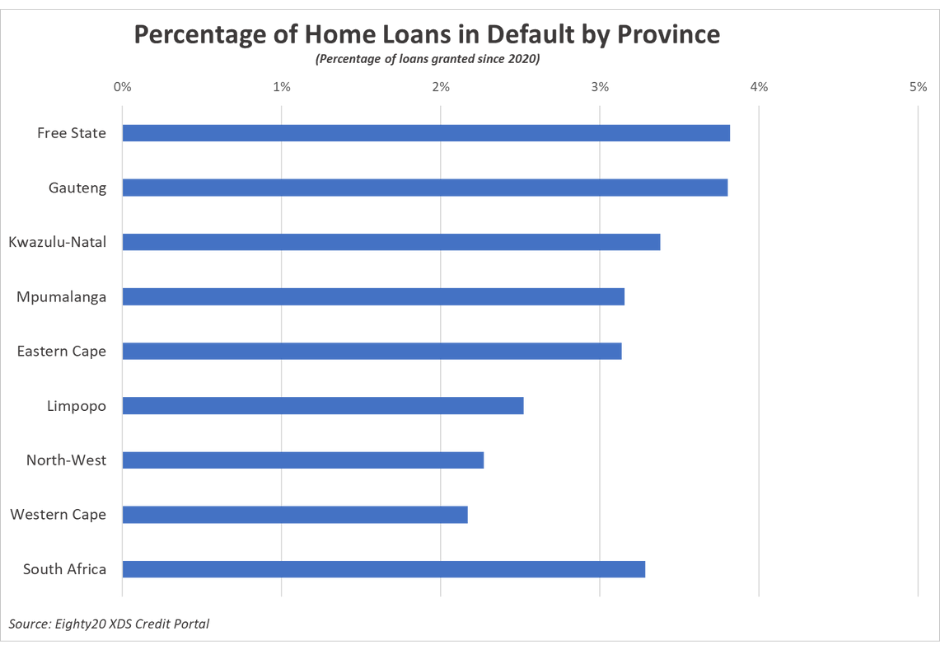

In terms of home loans in default, the Western Cape has the lowest in South Africa at 2.2% of home loans granted since 2020 going into default, compared with Gauteng (second highest at 3.8%) and a national average of 3.3%. Semigration has likely contributed towards the value of all home loans in the Western Cape increasing by 67.5% since 2019 Q3, while the value of the average home loan has gone up 26%, more than any other province. Over that same period, the value of all home loans in Gauteng increased by 37%, and the average home loan by 17%.

In terms of Eighty20’s segmentation, 2020 Q4 to 2022 Q4 saw a large increase in Heavy Hitter home loans per quarter during the lowest interest rate environment South Africa has seen in decades. New home loans in the Western Cape peaked for this segment at nearly 5,500 new loans in quarter three of 2021 – 73% higher than 2019 Q3. With the relentless interest rate hikes in the past 18 months however, that number is now down 32% from its peak. Although this trend has also been visible across all provinces, the proportion of Heavy Hitters taking out mortgages in the Western Cape now compared to four years ago has gone up 10%, compared to a decrease of 5% in Gauteng.

Low Growth in Credit Extension

Whether due to individuals scaling back on the number of loans they hold or defaulting on their loans, there has been a consistent reduction in the number of secured loans held by certain customer segments. While there has been a decade long trend of declining rates of new credit market entrants, loan values have increased. The number of credit active individuals is roughly the same as it was in 2019, and the value of loans has grown at only a CAGR ~5.4% in four years.

|

A segment view, especially for secured credit, unpacks this trend a bit more clearly. The wealthiest segment – the Heavy Hitters, have been taking on more secured credit in value and volume over the last four years, while almost the complete opposite has been happening in the Middle Class. The Mass Credit market has also been scaling back on the number of secured credit products over the past two years, with the value of loans remaining largely stable.

Some Green Shoots

There were also some positive developments in the quarter beyond the Western Cape. The significant July decline in CPI opens up the possibility that SARB will leave the repo rate unchanged next month, and many analysts point to a possible drop in interest rates as early as 2024 Q1. Unemployment figures did not worsen in the last Labour Force Survey. The quarter one GDP figure was a welcome surprise as well. There is also a much-needed push from the private sector through B4SA to help tackle infrastructure, crime and electricity concerns. And reflecting on the Western Cape’s positives, perhaps this sleepy province could lead the country out of the doldrums,” concludes Fulton.

Download the Credit Stress Report