Increased credit stress crippling even the wealthiest

Download the Credit Stress Report

Economic conditions leaves both struggling and wealthy South Africans spiralling into debt

As South Africans began 2023 experiencing a quarter of every day without electricity, coupled with rising interest rates and a weakening currency, it seems the significant pressure consumers were feeling at the end of last year has only escalated.

Eighty20, a consumer strategy, analytics and research company has released its 2023 Q1 Credit Stress Report in collaboration with Xpert Decision Systems (XDS). The report unpacks the credit behaviour of four Eighty20 National Segmentation (ENS) consumer segments that make up 78% of all credit active South Africans and 92% of all loan value. These segments are Mothers of the Nation, the Mass Credit Market, Middle Class Workers, and the Heavy Hitters.

“The credit market has begun the year with the number of defaults and overdue balances up QoQ for the first time since Covid. The Covid lockdown saw the total number of people with at least one loan in default rise dramatically, but that metric had been broadly in decline ever since. The trend for total overdue balances mirrored defaulters with an increase of 3% QoQ for the first time since Covid.” says Andrew Fulton, Director at Eighty20

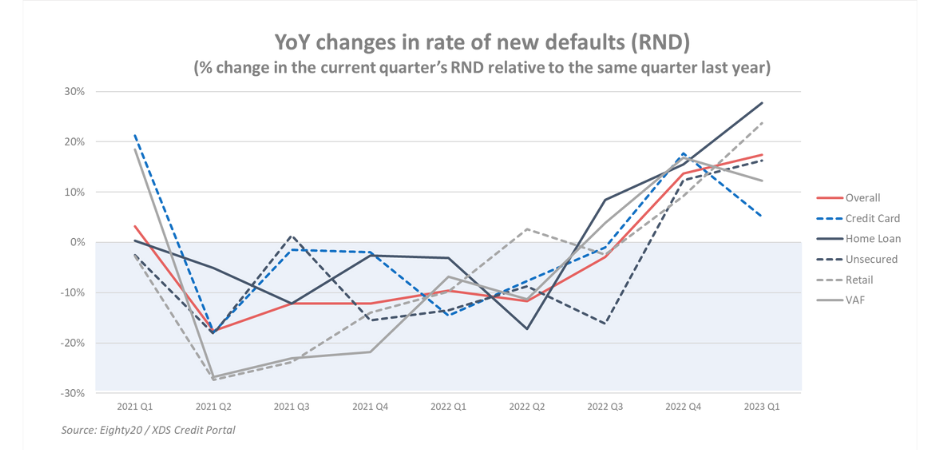

Loans newly in default (the proportion of current loan balances that went into default during the quarter) was up by 17.4% over the last year. This change in rate of new defaults (CRND) is an early warning sign for the state of credit in the country, and has been in double digits for the last two quarters. The CRND increase is driven particularly by new defaults in secured products (home loan at 27% & VAF at 12%). A clear sign that even the wealthiest customer segments – Middle Class Workers and Heavy Hitters – are also feeling the pain of South Africa’s economic woes.

Home loan and vehicle finance causing increased stress

Home loans are causing significant pain for consumers with a steep 27% YoY increase in average mortgage instalments due largely to rising interest rates. The 50-basis point interest rate hikes in March and May have brought the prime lending rate to 11.75%, the highest it has been since 2009. These rate hikes have had the effect of increasing instalments by R4,600 a month for a R1.5m loan taken out mid-2021.

Nearly 99% of home loan balances are held by the Heavy Hitters (76%), Middle Class Workers (17%) and Comfortable Retirees (6%) segments. The Heavy Hitter segment accounted for R87bn (11% YoY) growth in balances with Middle Class Workers balances shrinking by 4%, bringing the overall increase to R82bn, a nearly 8% increase with average monthly instalments up YoY by 27%. The home loan book for Middle Class Workers (by value and holders) has been in decline since 2021 Q4, with the total home loan book across all customers only growing 9.7% over that period. Quarter four saw Heavy Hitters experiencing a 24% increase in home loan balances going into default YoY, while Q1 2023 has seen that figure increase further to 34%, painting a depressing picture for the retail property market where economic challenges and rising interest rates are depressing growth.

For the Heavy Hitters and Middle Class, VAF shows a similar pattern. The VAF loan book has shrunk by 8% YoY for the Middle Class, with a CRND of 23% YoY for the 600 000 Middle Class VAF holders. The rate of new defaults on VAF for Heavy Hitters and the Middle Class has increased consistently since mid-2022, while the number of people with this type of loan has been dropping since the end of 2021.

With an instalment to income ratio for the Middle Class that has now breached the 70% mark, a real concern is how these customers are able to continue paying VAF and home loans. Heavy Hitters currently have a 60% instalment to income ratio (5% YoY increase). For all credit active South African’s this ratio sits at 44%.

Credit Card defaults flattening but still rising

Total credit card debt for the Middle Class continues to rise, and is up 7% over the year, with average credit card loan balances up 8%, to more than R31 000. Average credit card overdue balances as a percentage of total balances for the Middle Class is now at 19% compared to 8% for Heavy Hitters.

2022 Q4 saw a sudden 20% jump in the rate of new defaults YoY for credit card debt. This quarter the rate of new defaults has remained stable albeit at this new higher rate. Total credit card balances show the same trend, remaining about 12% higher than last year.

Retail remaining stubbornly resilient

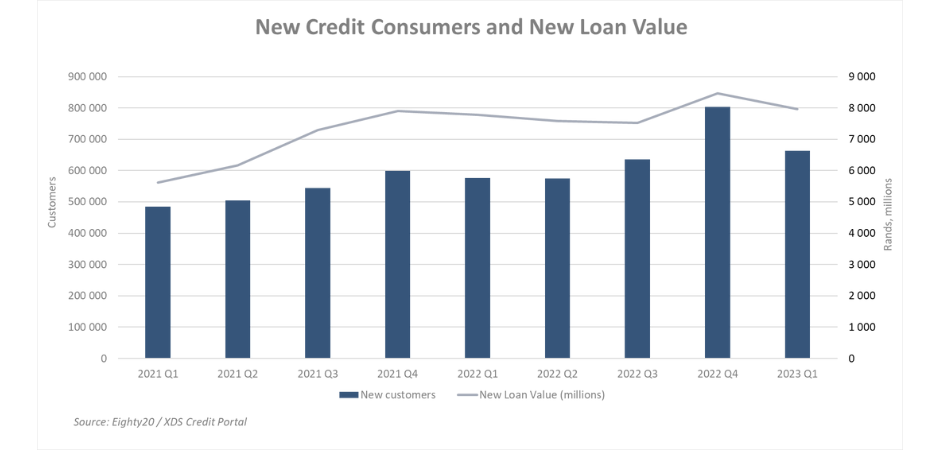

Appetite for credit, while lower than last quarter, still saw nearly 665 000 people entering the credit market this quarter with R7.9bn in new loan value (increase of 1.1%). This growth came predominantly from new retail accounts.

The news is still somewhat positive on the retail front with retail sales, according to the Retail Sales Index, up on last quarter by almost 1%, which is surprising given that Q4 includes Christmas and Black Friday. Retailers in textiles, clothing, footwear and leather goods led the positive contribution. The number of retail account holders increased in 2023 Q1 by 0.6% QoQ to 13.6m, but the change in the rate of new defaults has grown a worrying 24% YoY and 18% over just the last quarter.

Mothers of the Nation taking strain

The latest unemployment figures showed that domestic workers have fared particularly poorly since Covid with about 200 000 fewer jobs than a few years ago. This could be an outcome of the financial pressure the Heavy Hitters and Middle Class are facing, causing them to rethink domestic help. One way a homeowner under pressure could free up some money would be to clean their house and tend their garden themselves.

Most of the 830 000 domestic workers in South Africa are in the ENS segment Mothers of the Nation. The ENS has two low-income segments – the all-male Hustling Males and their female counterparts the Mothers of the Nation. Both are mainly unemployed or underemployed (likely in an elementary occupation) with the majority receiving government grants. Their relevance in terms of credit volume is negligible, with only 10% of the combined 13m people holding any form of credit, and total value of their loans is about a tenth of a percent of South Africa’s loan book. But for the Mothers themselves, their stress is significant. Some 96% of the value of loans for this segment is made up of retail and unsecured loans, with the CRND up nearly 50% for both products. Loan balances on both these loans tends to be fairly low (less than R2 000), but nearly 14% of all retail loan value goes into default every quarter, which is double the South African retail default average.

“The credit stress amidst a tough economic climate gives us a dim view of the future, when the wealthiest segment feels the pinch it’s a clear depiction of financial stress. With this in mind, it’s even more crucial that the middle to lower income segments will need to be frugal with their finances in order to work smarter with their access to credit.” concludes Fulton.

Download the Credit Stress Report