Credit Stress Report Reveals SA Youth on a Slippery Slope

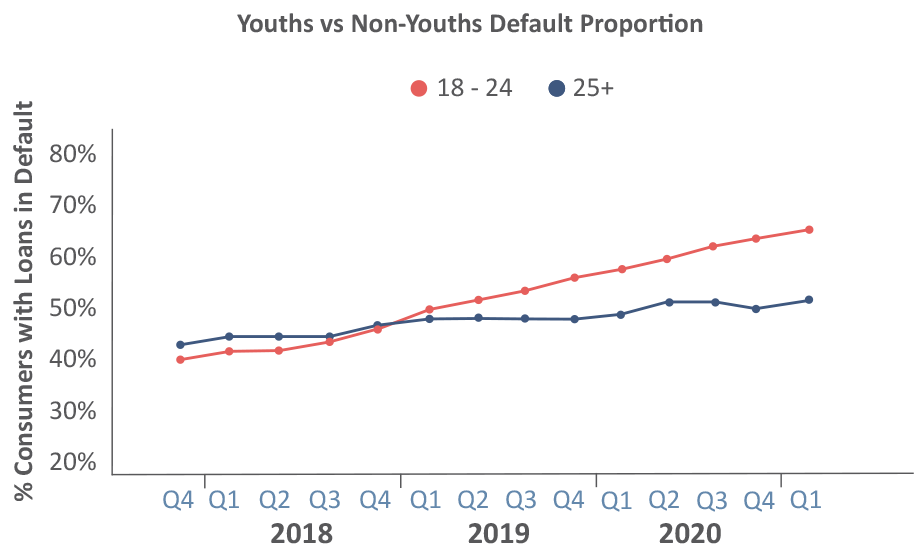

In its Credit Stress Report for 2021 Q1, Eighty20, a consumer analytics and research consultancy, revealed an alarming trend in the rate of default on credit repayments amongst South Africa’s youth.

Eighty20 found that if the trend in defaults over the last 4 years continues, 100% of credit active individuals between 18-24 years old will be in default by 2027.

Andrew Fulton, director at Eighty20 explains: “There are roughly 1.2 million people between the ages of 18 and 24 who are credit active, out of about seven million, so almost 20% have some form of credit product – mostly retail credit, but some unsecured and credit card.”

To unpack this further, the data reveals that 90% have a retail store card, 11% have unsecured debt – such as a personal loan – and 9% have a credit card. Only 2% have vehicle asset finance and almost none have a mortgage. The value of all this debt is roughly R9.6 billion, with R1.5 billion overdue as at 31 March. Of all credit active 18-24-year-olds, only 37% have no loans in default, and more than half are in default on all their loans.

Several factors could be contributing to the increasingly dire situation. AMPS data consistently illustrated that more than half of 18-24 year-olds agree with the statement: “These days there is no point in saving for something, it is better to buy on credit.”

Fulton thinks this belief is at least partly fuelled by the fact that it’s simply getting more and more difficult for people to live within their means.

That’s not all there is to it, though. “For young people to qualify for more substantial types of credit – such as vehicle or mortgage loans – they first have to build up a credit history. Retail accounts, for example, are an easy way to get that history, as there is less emphasis on affordability in the application process, but you have to keep that record clean if you want to move into other debt.”

This puts South Africa’s youth between a rock and a hard place. Being responsible and avoiding credit means you have no credit history to build on but defaulting on your debt could ruin your chances at getting a mortgage, vehicle asset finance or even a small business loan later.

“The default rate amongst young people is even more concerning when cast in the light of South Africa’s alarming youth unemployment rate – sitting at 75% at the moment.” Fulton says. “As a country, we know we need to create more jobs and provide more support for young entrepreneurs. We know there is merit in teaching young people how to create work for themselves, rather than focusing, for the most part, on how to become just a part of the workforce.”

“But despite these macro issues, which are especially top-of-mind for South Africans in general, there are micro issues that need to be addressed,” he points out. “Young people are not learning to be financially savvy, and do not seem to understand the consequences of going into default. There should be more accountability – on the side of those issuing credit, but also on the side of the youth and society to be more financially responsible.”

Asked what young people should do to develop a more responsible approach to their finances, Fulton says: “Start with keeping a simple budget that tracks your income and expenses every month. Think carefully about what you need versus what you want or feel societal pressure to have, and focus your spending on what you need.”

“Lastly,” he says, “if you already have credit products like a credit card or retail accounts, take a look at your current credit score to see if the track record you’re building for yourself is serving your best interests. XDS – our partner in the Credit Stress Report – have a free service that you can use to check your credit record, called Splendi.”

“We’ve had a stark reminder in recent weeks that disillusioned, unemployed youth can be a tinderbox waiting to ignite. And, while there are undoubtedly many factors that have fuelled the unrest, mounting debt pressure on young people will not ease their challenges in the longer term. It is important for us in the private sector to do what we can to educate our employees about personal financial management wherever possible, and for lenders to consider playing a role in financial education for the youth as well. For young people who are credit active, remember that life can be long,” Fulton concludes, “and there are repercussions for your current financial behaviour.”

The Credit Stress Report 2021 Q2 will be out later this month. Let’s hope we start seeing youth default rates improve.

If you’d like to be among the first to see the new report, let us know via the form below.