Credit Stress Report 2025 Q1 is now available

Listen to the Kaya Biz interview here: South Africans earning over R30,000 or more are also struggling

Download the Credit Stress Report

Eighty20, in collaboration with Xpert Decision Systems (XDS), has released its 2025 Q1 Credit Stress Report, examining consumer credit behaviour and the key economic events that shaped the first quarter’s landscape.

Economic Context and Global Uncertainties

Our previous report highlighted subdued yet positive developments in retail sales, GDP, and inflation. However, the US election outcome and President Trump’s tariff policies have introduced significant uncertainty and volatility into global markets. While the full impact of these geopolitical tensions on South Africa’s economy remains to be seen, this report examines how the first quarter unfolded against this backdrop.

Both Moody’s Ratings and the Bureau for Economic Research (BER) have revised their 2025 real GDP growth forecasts downward from 1.8% to 1.5%, reflecting increased caution about the year ahead.

First Quarter Reversals

The first quarter of 2025 marked a reversal of the encouraging trends observed at the end of 2024, and consumer credit behaviour shifted in response to these economic pressures. Key developments included:

- Currency pressure: The exchange rate shifted unfavourably against major trading currencies

- Rising fuel costs: Domestic fuel prices increased, with petrol prices climbing 3.9% quarter-on-quarter, driven by global oil price increases

Credit market dynamics

- Overdue balances remained high with home loan overdue balances up 21% YoY and Credit Card up 18% YoY. Nearly three quarters of this overdue debt is with the three wealthiest segments (Middle Class, Heavy Hitters and Comfortable Retirees) suggesting the stress is across all sectors, including the top end, despite lower inflation and three interest rate cuts in a year.

- The credit market continued expanding, with the number of credit-active individuals increasing by 2% year-on-year, while the number of credit products grew by 4%.

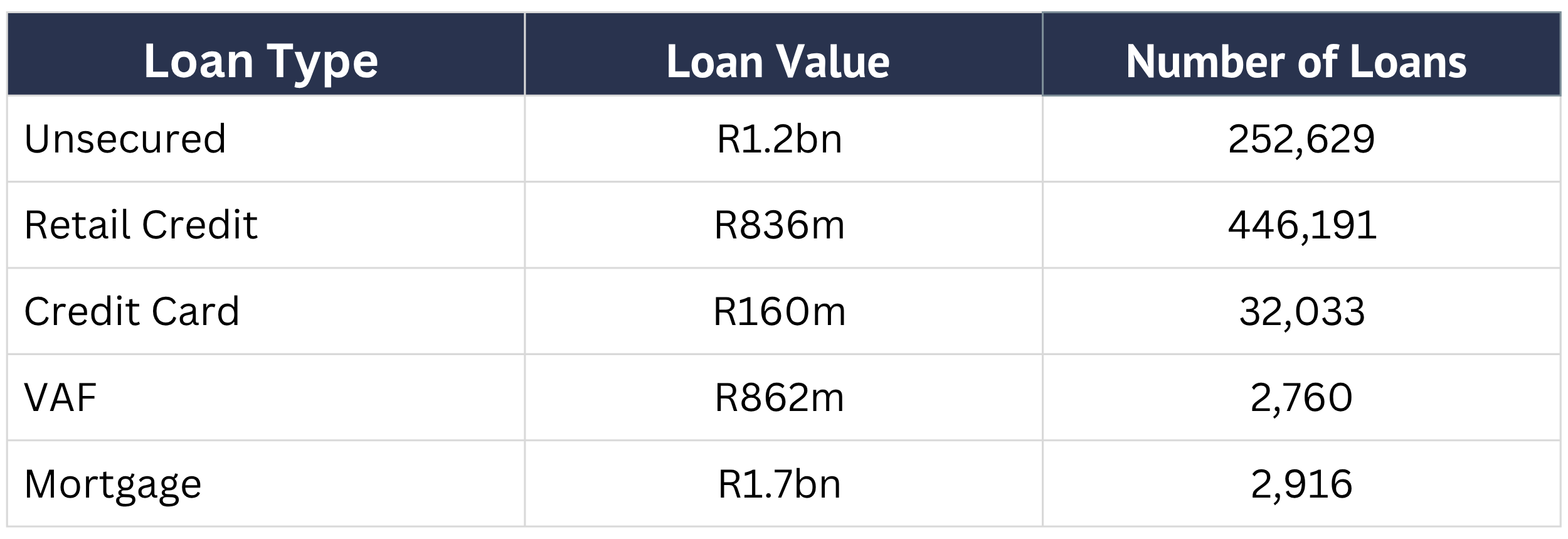

- Total loan balances reached R2.56 trillion, representing a R127 billion increase (5.3% YoY). Credit card and retail credit segments drove this growth, each expanding by more than 7%.

- Total overdue balances climbed to R208 billion – a R25 billion annual increase representing 8.1% of total outstanding debt.

- For the first time in two years, the number of loans in arrears increased marginally quarter-on-quarter by 353,395 to 17.97 million accounts, though the proportion of individuals with defaulted loans continued to decline.

- Every month between half to two-thirds of all new loans opened are retail credit, and about a third are unsecured credit. Together these products make up less than 50% of all new loans by value.

As we navigate an uncertain and volatile global economy, South Africa’s wealthiest consumer segments continue over-extending themselves with unsecured credit, while overdue balances remain persistently high. This report provides an analysis of how these macroeconomic headwinds translated into credit market performance and consumer financial behaviour during the opening quarter of 2025.

Download the Credit Stress Report