South Africans put cold beer at the top of their drinks list

Read Retail Brief article here: Insights into SA’s top alcohol brands and changing consumption habits – Retail Brief Africa

In South Africa, alcohol takes centre stage for toasts, whether it’s a special occasion or a sports game. A beer around the braai or a glass of wine at a book club has become a lifestyle. While South Africans revel in their liquid traditions, they do not hold the title for the highest alcohol consumption in the world.

According to the World Health Organisation, Tunisians claim that distinction with a per capita alcohol consumption of 35 litres (drinkers only). While South Africa ranks fifth with a drinkers-only per capita consumption of 30 litres. Strikingly, four out of the top five countries with the highest drinkers-only per capita alcohol consumption are from Africa, three of which belong to the SADC region (Eswatini with 34 litres and Namibia with 33 litres).

|

Noteworthy is the fact that nearly 50% of South Africa’s adult population consumed alcohol in the past month, with beer being the preferred choice for 41% of them.

Non-Alcoholic beer is a new category being measured and suggests that half a million consumers choose that category. It certainly seems like a health and taste choice, as more than ¾ of these non-alcoholic beer drinkers also drink regular beer.

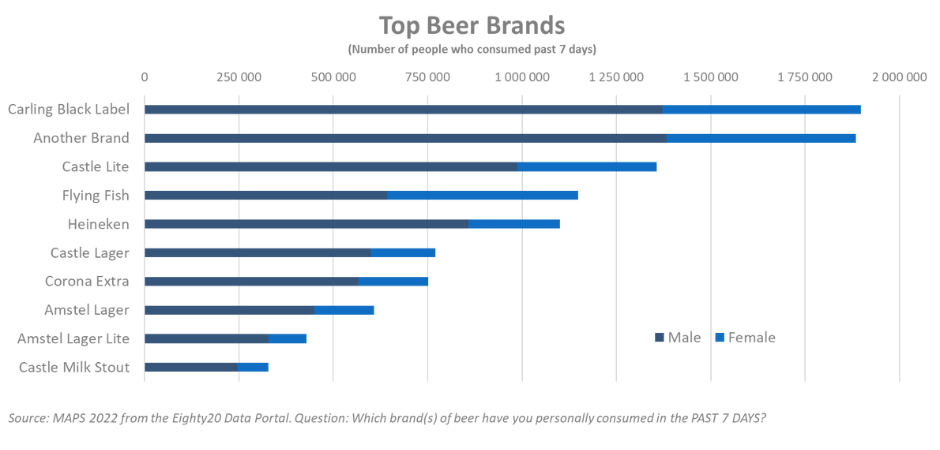

Eighty20, a consumer strategy, research and analytics business, specialises in helping brands better understand customers. MAPS data, a nationally representative survey of 20 000+ South Africans, available on Eighty20’s Data Portal unpacks the number of people who drink (but not the volume), and the brands they consume. The data shows that smaller brands have seemingly stormed the Castle over the past decade – while big brand Carling Black Label leads the pack, consumed by nearly 2m South Africans in any given week, with a hive of activity in the sector, it comes as no surprise that second on the list are craft beers and boutique brands.

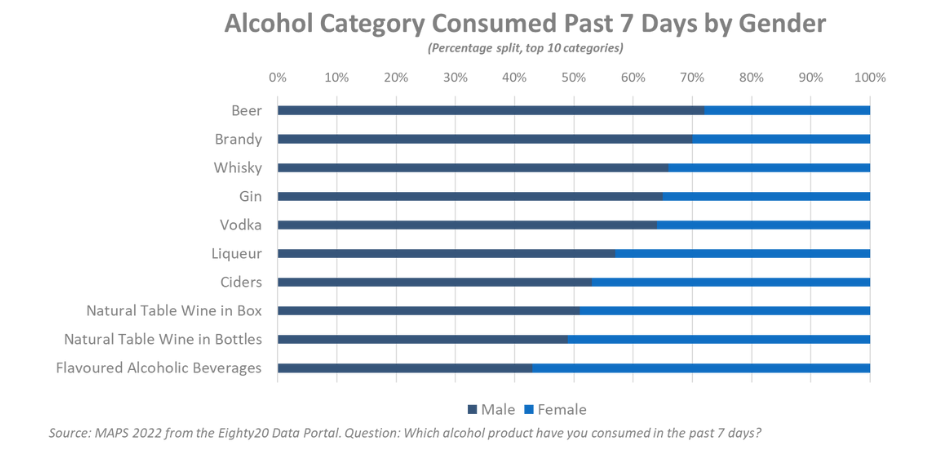

Roughly half of all South Africans have drunk some form of alcohol in the past month, but males dominate in terms of consumption, with 62% drinking some form of alcohol weekly or monthly, compared to 36% of women. Looking at the male / female split by category, 72% of beer consumers are male, 70% for brandy, and 66% for whisky. The top three for females differs completely, with champagne and flavoured alcoholic beverages (58% female consumption), bottled wine (51%) and boxed wine at 49%. Interesting that in a country where 72% of beer consumers are male, three of the top five alcohol brands have at least 50% female consumption.

Our ubiquitous love for beer is still evident, but consumption over the past ten years has changed in terms of key brands consumed. In 2013, the top beer was Castle Lager, followed by Castle Light, Carling Black Label, Heineken and Hansa Pilsener. Ten years later, 2023 sees Carling at number one, other brands (which includes a massive influx of small independent brands and craft beers) at second, Castle Light, then Flying Fish and Heineken – bumping Castle Lager from the top five in its entirety.

|

“Flying Fish, which launched a decade ago is now the 3rd most popular beer brand, ahead of Amstel, Castle Lager and Budweiser, brands that hit significantly harder in terms of ad spend, according to the 2023 Liquor Industry Report produced by Ornico. It is also the most over-indexed beer for women, second only to Black Label which enjoys a whopping 60% more consumption,” says Andrew Fulton, Director at Eighty20.

The top five alcohol categories for men in 2023 are beer, gin, cider, liqueur (nearly half of which is Jägermeister) and boxed wine. The top five ten years ago included whisky and brandy. For women in 2023 it is the same grouping as men, only replacing gin with flavoured alcoholic beverages. Perhaps also reflecting the current economic climate, ten years ago, women’s top five included champagne and wine in a bottle. The flavoured alcohol category has grown significantly, as shown by the massive growth in brands like Flying Fish and Brutal Fruit, particularly amongst women.

Category loyalty is another interesting lens through which to view consumption. Two thirds of craft beer drinkers consume traditional beer (with Flying Fish and Amstel Radler in their top five choices), while only 2% of traditional beer drinkers consume craft beers. And while beer is the second choice of most hard tack drinkers, for wine drinkers, and particularly champagne drinkers, beer is much further down the list of their choice of alternatives. Flavoured alcoholic beverage drinkers also prefer cider to beer, but if they drink beer, it is likely to be one of the ‘lite’ brands. And interestingly, while only 13% of South Africans who consume beer live in the Western Cape, for craft beer the figure is 37%!

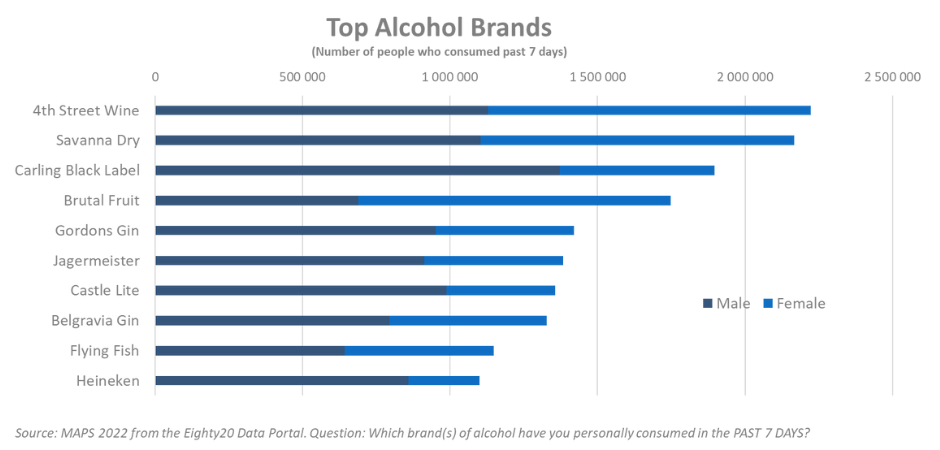

Top Brands overall

The most surprising alcohol brand at number one overall is 4th Street Wine, a variety of sweet wines from Distell. 4th Street Wine sells well to lower income consumers and in tough times, with five litre boxes available for R140 from Pick n Pay (equivalent to R21 for a bottle). Coming in at second and leading the cider category is Savanna Dry followed by Carling Black Label, Brutal Fruit and then Gordons Gin at number five. Gordon’s dominates the Gin category attracting 41% of all gin consumers. Brutal Fruit also dominates its category at 61% of all drinkers in that category.

Taking a different twist on consumer preferences, the most over-indexed brands for sports enthusiasts are:

- Adventure sports: Tafel, Bavaria, Soweto Gold

- Cricket: Windhoek Light, Amstel Lager Radler

- Fishing: Miller’s, Lion, Soweto Gold

- Formula One: Tafel, Miller’s, Guinness

- Rugby: Sol Cerveza, Hansa Pilsner, Windhoek Draught

- Soccer: Tafel, Windhoek Light

|

“When reviewing these insights, consumption by category has changed significantly over the past 10 years. With beer still largely consumed by the masses, it would be interesting to see how the ever-changing economics of the country and entry of niche brands shift consumption habits. Brands will need to continually innovate to the taste of the consumer and their pockets.” concludes Fulton.