Vehicle Asset Finance sees recovery as credit terms change significantly

Read the BusinessTech article here: Major win for South Africa’s middle class

The third quarter of 2025 saw continued credit expansion from the previous quarter, noticeably in vehicle asset finance (VAF), reflecting significant increases in originations in October. The number of bank and retail loans rose by 7% YoY across all categories except home loans, with personal loans contributing significantly through 8% YoY account volume growth.

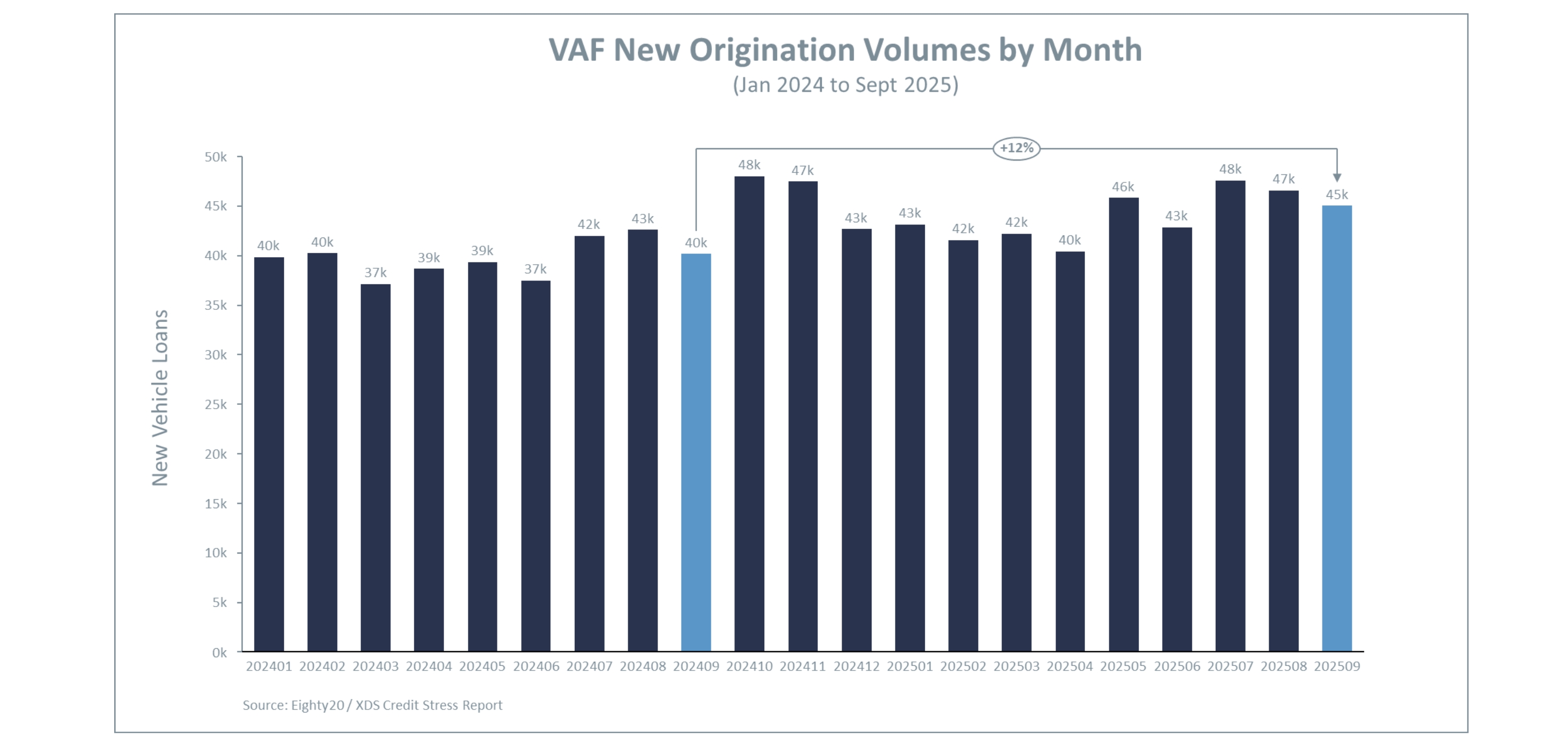

Looking at VAF, account volumes marked three consecutive quarters of growth, while outstanding balances surged 6.6% YoY. New VAF business volumes increased by 12% YoY.

The VAF market faced significant headwinds in 2023 and 2024. The lowest-ever prime rate after the pandemic was followed by ten consecutive increases between November 2021 and May 2023. By September 2024, when the prime rate finally began declining, approximately 140,000 middle-class consumers had exited the VAF market – roughly 7% of total VAF holders. This contraction was driven by a perfect storm of pressures: stagnant wages coupled with record-high inflation squeezed discretionary income, while rising fuel prices, the presence of alternative transport like Lyft and Uber, widespread work-from-home adoption, and above-CPI vehicle price increases combined to depress car sales and VAF volumes throughout this period.

|

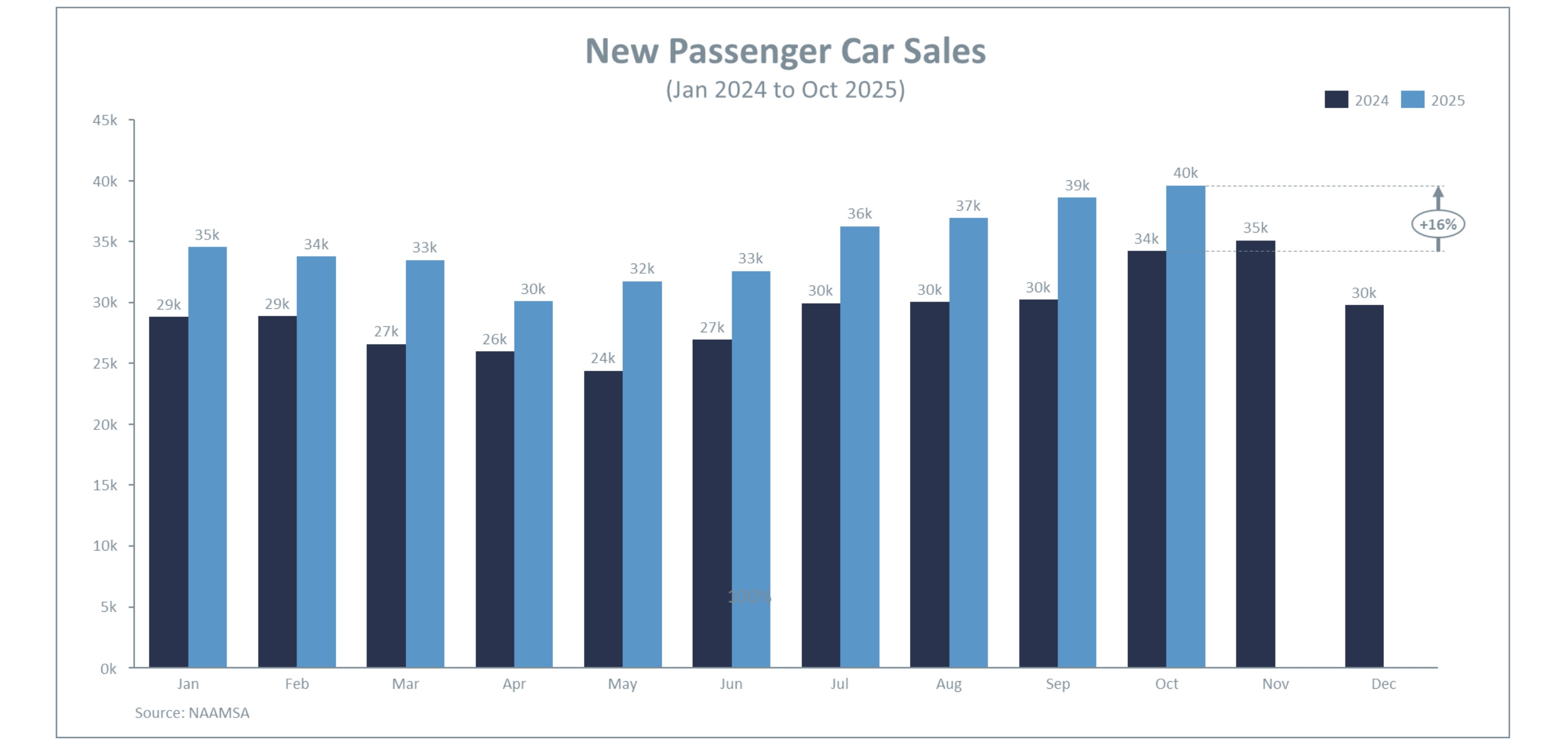

The market has since rebounded significantly. October 2025 saw 55,956 new vehicles sold – the highest monthly total in more than a decade and a 16% year-on-year increase from 48,222 units in October 2024 according to the National Association of Automobile Manufacturers of South Africa (NAAMSA). Passenger car sales reached 39,610 units, the best performance since October 2014. This marks 12 consecutive months of growth and the fourth straight month above 50,000 units.

The used car market was similarly buoyant, with September 2025 recording the year’s highest sales at 33,907 units – a 16.4% YoY increase – though October’s 3.1% YoY growth was more modest. This surge in used vehicle demand was reflected in WeBuyCars’ impressive results for the year ended 30 September 2025: revenue rose 13.1% to R26.4 billion, while core headline earnings climbed 15% to R937.6 million, underscoring the growth in South Africa’s used vehicle market.

Several converging economic factors have encouraged borrowers to re-enter the VAF market. The influx of more affordable Chinese imports in a short period of time – nearly half of the 14 Chinese car brands now active in South Africa entered the market within the past two years – has shaken the market. While no Chinese brand ranks among the top five bestsellers individually, their collective impact has been profound: Chinese brands have surged from less than 3% of the total vehicle market in 2020 to approximately 13% more recently. Most importantly, however, the Chinese brands have entered the market at generally more affordable price points. In spite of the gradual repo rate cuts since November 2024 and the relatively low CPI, we know that consumers have remained under pressure to meet the cost-of-living demands (especially considering cost of food and basic services).

|

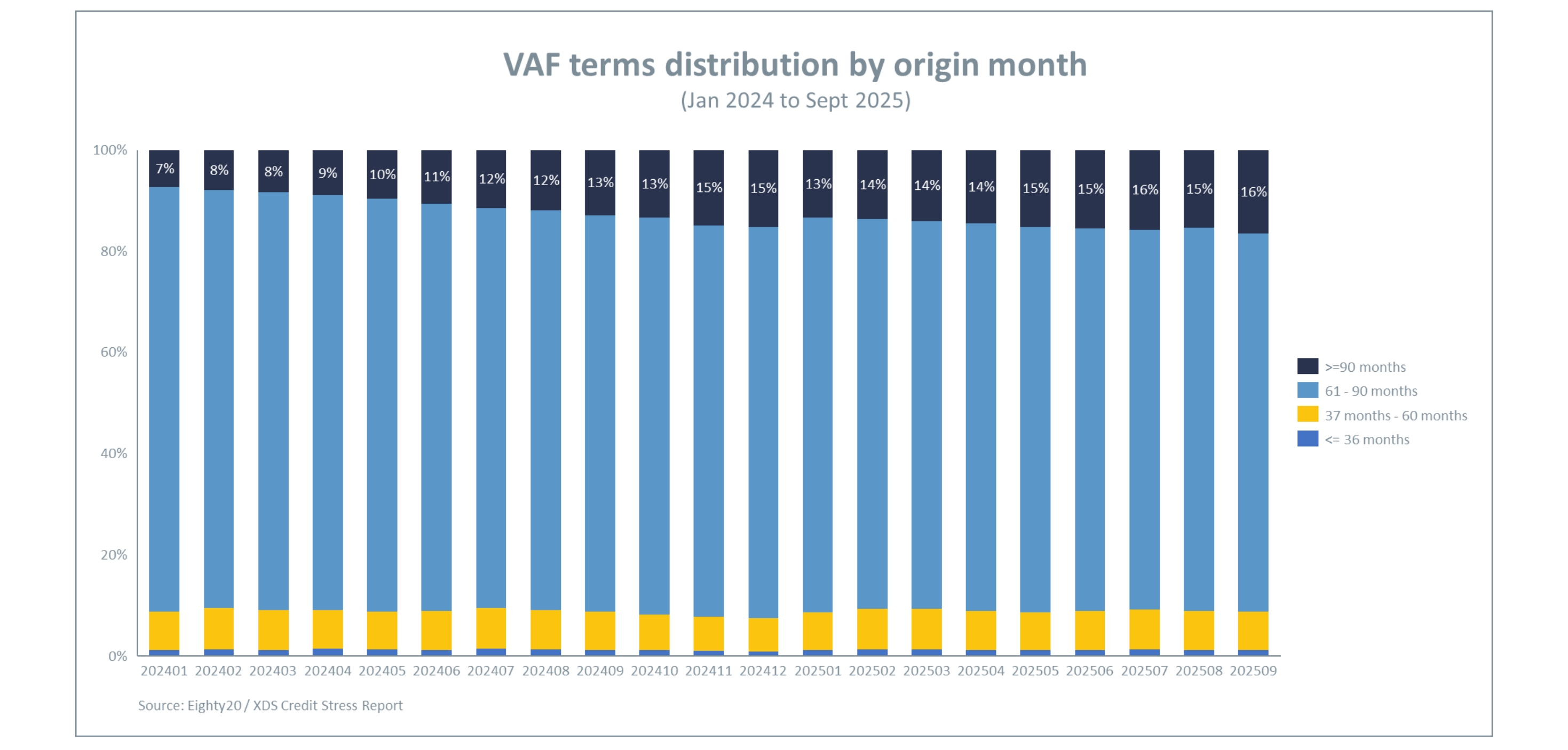

Another interesting development in the credit data, that further contributes towards the easing of affordability pressure, was the gradual change in credit terms of VAF originations since 2024. At the beginning of 2024, roughly 7% of VAF loans had terms of 90 months or more. That proportion has more than doubled to 16% in September of this year. These longer terms have a positive effect on consumers by making monthly repayment amounts more affordable.

“The significant change in the issuance of VAF loans is a remarkable trend, and it’s being driven by specific consumer groups. Nearly 88% of VAF by value is concentrated in two Eighty20 consumer segments: the Middle Class Workers and Heavy Hitters. As we’re seeing high vehicle sales numbers, these two segments are driving the volumes. A combination of declining interest rates and petrol costs, extended repayment terms, more affordable vehicle options – particularly Chinese imports – and a stronger rand have created these favourable conditions.” concludes Ans Gerber, Head of Data Products.