Thin File Clients in South Africa’s Financial Landscape

Watch the eNCA interview here: Cost of living | 700,000 new credit individuals added in Q1 – eNCA

In South Africa, credit touches the lives of everyone, whether in small everyday purchases or major life decisions, underscoring its importance in building opportunity, stability and financial freedom. Approximately half the adult population collectively holds R2.56 trillion in outstanding debt. Data from the World Bank suggests that domestic credit to the private sector (financial resources provided to the private sector – consumers and businesses – by financial corporations, such as through loans) was over 90% of GDP in 2023.

An individual’s credit score functions as a financial gatekeeper, determining not just lending access and terms, but is a requirement to be able to access credit. In turn, credit enables financial inclusion and wealth creation, especially among the poor. A healthy credit score also opens access to other services – cell phone contracts, rental agreements and even employment opportunities. Expanding the adult population’s access to a credit score is critical to driving economic opportunities among previously excluded individuals but also helps develop our formal economy.

|

The “Thin File” Challenge

First-time credit applicants – dubbed “thin file” clients, are those that have applied for a loan for the first time in the past 3 months. These applicants face a paradox: they need credit to build a credit history, yet lack the history required to access credit. In addition to the very poor, who may not have permanent, formal employment, and lack family members who could stand surety on a credit contract, this also creates substantial barriers for wealthier segments such as young adults, immigrants, and gig economy workers who often encounter loan rejections or receive unfavourable borrowing terms.

The National Treasury has recognised this challenge and prioritised financial inclusion initiatives, such as the Financial Inclusion Policy Framework which aims to (inter alia) deepen financial inclusion for individuals. This has prompted innovative solutions from forward-thinking companies who now leverage alternative data sources including utility payments, rental history and mobile phone records to assess creditworthiness.

Alternative Data Solutions

Eighty20’s National Segmentation solution is an example of this approach, enriching customer data with a thousand variables, fused from numerous sources in a POPIA-compliant manner, to enhance customer profiling. This comprehensive approach has demonstrated effectiveness through credit retailer partnerships, delivering:

- Enhanced performance in fraud, collections and category purchase behaviour prediction

- Predictive capabilities that closely match traditional credit bureau models

-

A breadth of variables that enable clients to build models not possible with credit data (i.e. propensity to purchase in certain categories)

These advances enable financial institutions to assess risk more accurately while expanding access to underserved populations

|

The thin file client

South Africa has roughly 20-million credit active individuals. In the first quarter of 2025, the number of new to credit individuals was just over 700 000, which is a 27% increase on the previous year, although this number varies quarter to quarter. There were more than a million new to credit in the second and third quarters of 2024 as inflation eased and the first repo cuts came in. The total debt taken on by these new to credit individuals in 2025 Q1 was R4.8bn.

Some key metrics for Thin File clients:

- Thin File clients differ from the credit active base in terms of demographics

- While three quarters of credit active individuals are over the age of 45, nearly half of thin file clients are under the age of 45

- Thin file clients are more likely to be female, with 88% unmarried compared to 67% of the credit population

- Nearly all (98%) thin file clients earn less than R20,000 per month personal income. More than a quarter of all credit active earn more than R20,000 per month

- Monthly, between a half to two-thirds of loans opened by first time credit applicants are retail credit, with about a third being personal loans. Together these products make up less than 50% of all new loans by value

- Credit Card usually makes up less than 5% of thin file credit

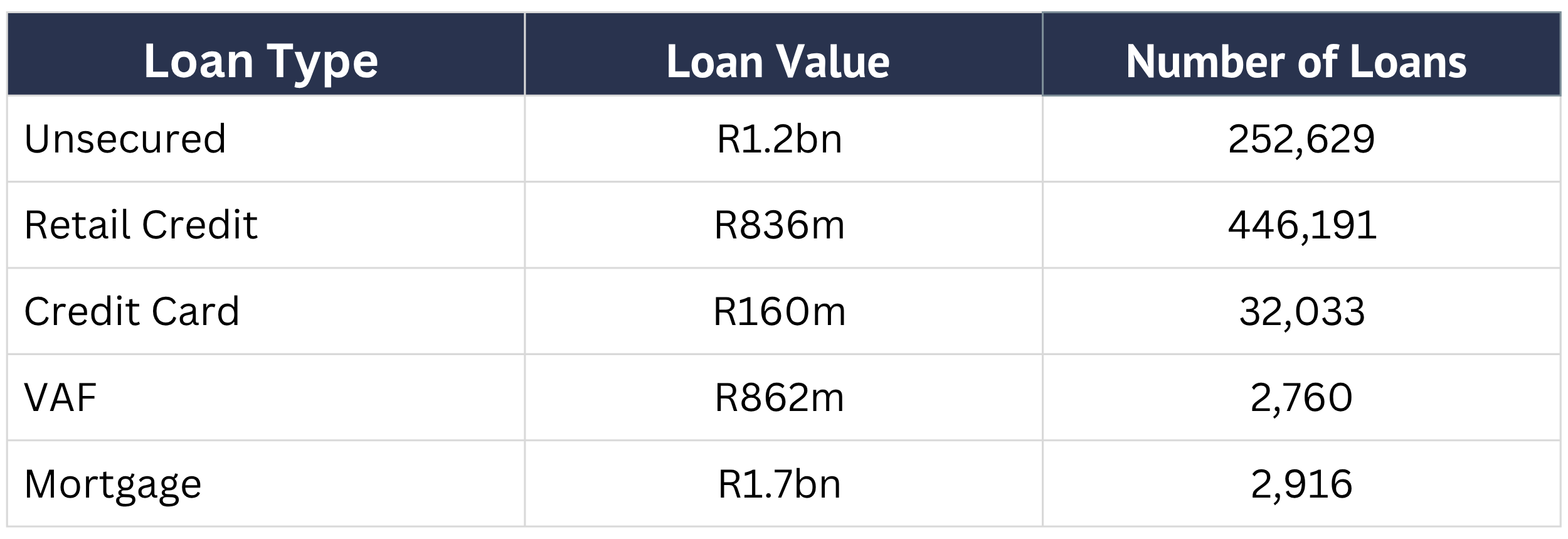

- Mortgage and VAF are not loan products new to credit individuals tend to take up, accounting for roughly one percent of new loans issued. In 2025 Q1, both combined were less than 6,000 loans in total, but they made up more than 50% of all loans by value to new to credit individuals

- The loan balance of new to credit individuals has been decreasing since 2024 Q2, down by 5.9% QoQ in 2025 Q1 to 4.8bn

ENS segments:

2024 Q1 marked a low point in the number of people entering the credit market, coinciding with the peak of South Africa’s high-interest rate environment (the first repo rate cut was in Q3 of that year). Since then, there was a steady YoY growth in both number and value of new to credit loans until this quarter, where there has been a drop in the number of new to credit. A growth in loan value was only seen in the Heavy Hitters and Students & Scholars.

Over the past four years, the overall number of credit active individuals has grown 4%, which is not too dissimilar from our population growth rate. The value of outstanding balances has also grown in line with GDP – 23% in nominal terms.

This quarter’s drop in new to credit both in number and value could be a reflection of South Africa’s broader economic adjustments, with thin file lending serving as both an economic indicator and financial inclusion barometer.

New to Credit 2025 Q1: